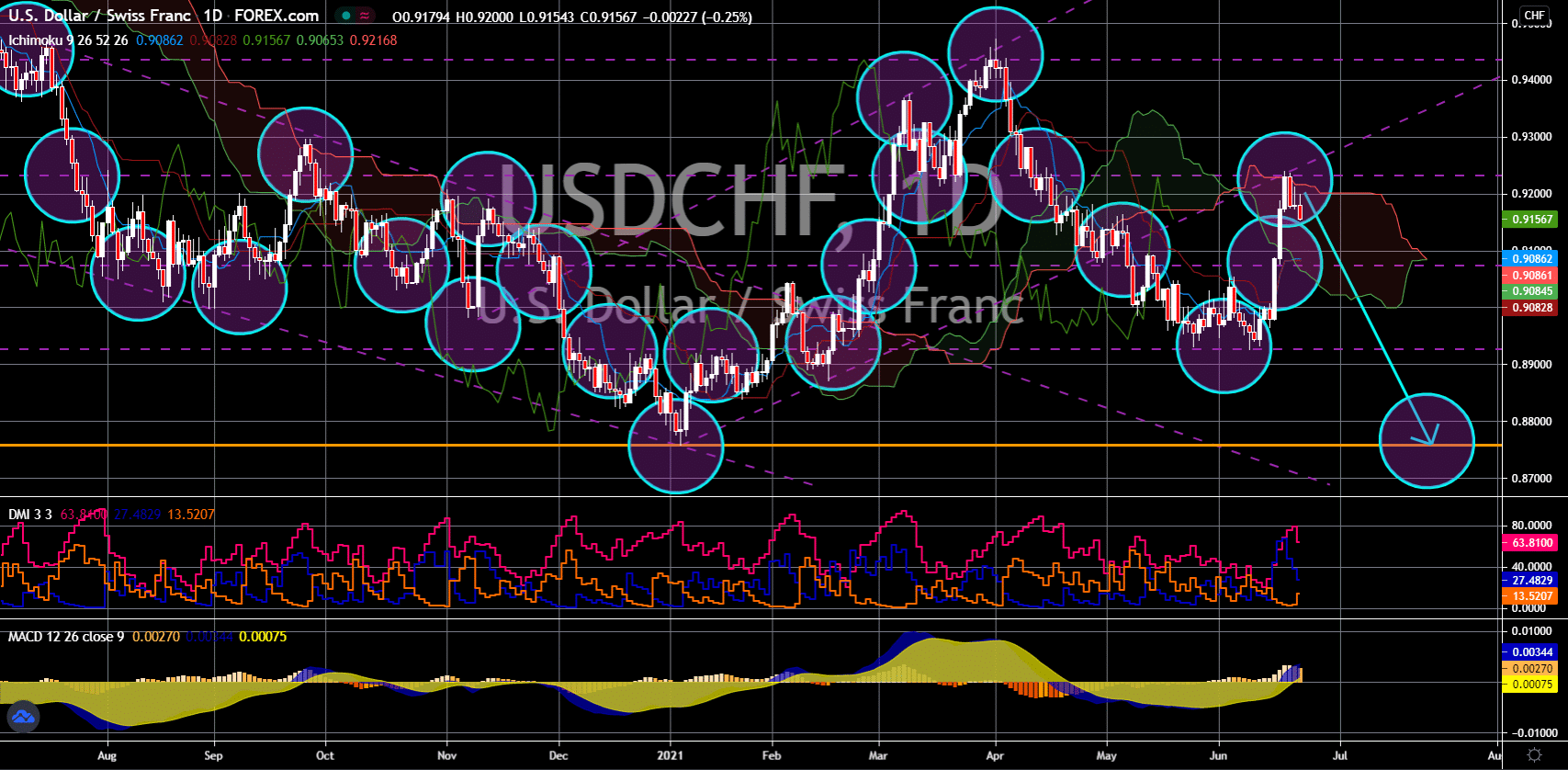

USD/CHF Nears 0.8890 Amid Rising US Yields

Quick Look

USD/CHF climbs towards 0.8890 during Asian hours on Tuesday, fueled by higher US Treasury yields.

The Federal Reserve is likely to maintain an unchanged monetary policy in the March meeting.

The Swiss National Bank (SNB) faces critical decisions in the upcoming policy meeting, with potential impacts on the Swiss Franc.

In a notable shift during the Asian trading hours on Tuesday, the USD/CHF currency pair ascended towards the 0.8890 mark. This movement was primarily propelled by a surge in US Treasury yields. This movement underscores the intricate dance between monetary policies and financial markets. Investors are keenly adjusting their strategies in anticipation of the Federal Reserve’s next moves. With the March meeting of the Federal Reserve on the horizon, market participants are bracing. They expect the decision-making body to uphold its monetary policy amidst escalating pressures. These pressures aim to sustain elevated interest rates in light of recent inflationary trends.

Unravelling the Bond Market’s Dynamics

The bond markets are currently witnessing a sell-off, prompted by emerging signs of robustness in the US economy. This resilience is leading traders to recalibrate their expectations towards fewer interest rate cuts within the year. Notably, the anticipation for rate reductions in June and July has seen a downward adjustment. Now standing at 55.1% and 73.7%, respectively, this recalibration responds directly to the bond market’s sensitivity. It’s sensitive to economic indicators and monetary policy forecasts, emphasizing the critical role these markets play in shaping financial strategies.

USD/CHF: Switzerland’s Economic Landscape

February’s data from Switzerland presented a mixed bag of economic indicators. The Swiss Trade Balance revealed a surplus of 3,662 million, slightly above the forecast but showing a decrease from January’s 4,701 million. The dynamics of imports and exports also painted a nuanced picture. Imports marked an increase to 18,812 million from 18,046 million previously, and exports slightly dipped to 22,474 million from 22,746 million.

The Swiss National Bank (SNB) has set an inflation forecast of 1.9% for 2024, a target presently outpaced by the actual inflation rate standing at 1.2%. February’s Consumer Price Index (CPI) data further illuminated the inflationary trends, showing a rise of 0.6% on a monthly basis, compared to a previous increase of 0.2%. As market participants turn their gaze towards the Swiss National Bank’s policy meeting scheduled for Thursday, the air is thick with speculation. Typically, lower interest rates tend to deter foreign capital inflows, potentially weakening the Swiss Franc.

The post USD/CHF Nears 0.8890 Amid Rising US Yields appeared first on FinanceBrokerage.